Health Care Platforms Need a Strategy Overhaul

To succeed, digital health platforms must shift their approach in three key areas.

News

- Gulf Nations Fast-Track AI Ambitions, UAE Leads Regional Readiness, says BCG Report

- AI Professionals form a Redefined Workforce. But Systemic Roadblocks Persist, Survey Finds

- AI-Driven Scams Surge as Microsoft Blocks $4 Billion in Fraud Attempts

- Identity-based Attacks Account for 60% of Leading Cyber Threats, Report Finds

- CERN and Pure Storage Partner to Power Data Innovation in High-Energy Physics

- CyberArk Launches New Machine Identity Security Platform to Protect Cloud Workloads

Jon Krause

The market for digital health services is growing rapidly. Worth more than $175 billion globally in 2022, it is expected to have a compound annual growth rate of 27% until 2030.1 Digital health services are provisioned over platforms that match patients with medical professionals while integrating artificial intelligence, telemedicine, and data analytics to improve the efficiency and effectiveness of health care delivery. Despite attracting both users and venture capital (with $45 billion in funding in 2021 alone), digital health platforms struggle to match the success of other platform businesses, with many failing to achieve profitability.2

Health care around the world is beset by major challenges, including increased demand for services, barriers to access for marginalized groups, and growth in health care expenditures as a proportion of gross domestic product (accounting for 18.3% of GDP in the U.S. in 2021).3 According to the U.S. Food and Drug Administration, digital health platforms can help address these challenges and more.4

Yet many digital health platforms struggle with viability. Our research on emerging digital health platforms during the past four years illuminates the unique challenges they face. Unlike many other types of platforms, they must integrate with incumbent solutions in a largely physical health care system, rarely benefit from strong network effects, and, due to tight regulations, often struggle to exert influence in ecosystem orchestration. These challenges call for a different approach to platform strategy.

In this article, we outline a three-part approach for making such platforms grow and succeed. Our research is based on more than 100 interviews with leaders and managers at 14 organizations in Sweden. (See “The Research.”) We learned much from the ongoing struggles of the companies we studied, but we also identified how they worked to overcome particular limitations and set the stage for profitable growth. Overall, our findings underscore that organizations seeking to introduce digital platforms in the health care sector need to rethink digital platform strategy, eschewing much of the standard advice that pertains to other sectors. But to illustrate precisely how senior leaders and managers might reimagine digital platform strategy in health care, we must first explain what a digital health platform really is.

Beyond Virtual Visits

Digital health platforms integrate various technologies, including artificial intelligence, telemedicine, and data analytics, to improve health care delivery. They employ platform-based business models, providing services through a unified interface that connects patients, physicians, and complementary service providers like pharmacies and physical care facilities.5 Examples include Teladoc in the United States, Kry/Livi in Europe, and JD Health in China.

These platforms do more than just add video calls and chat functions to existing health care services. In addition to enabling cost-effective consultations for common ailments, they offer innovative services such as online monitoring for chronic diseases and extend specialist care to include self-management. They also use AI to more precisely match patients’ needs with appropriate medical expertise. These features set the stage for a significant transformation of health care delivery by fostering improved diagnostics, triage, treatment planning, and interactions between patients and physicians.

However, migrating traditional service delivery to a digital platform — referred to as “platformization” — is especially complex and slow in health care. In all sectors, the process involves replacing vertically integrated companies or public actors with platform actors in the core value proposition, in order to facilitate digital transactions among many users and suppliers.6 Industries such as media (Meta), travel services (Airbnb), and transportation (Uber) have platformized rapidly, and network effects have created oligopolies or natural monopolies in winner-takes-all fashion. However, in health care, prior attempts at disruption by Big Tech companies such as Alphabet, Amazon, IBM, and Microsoft have been largely unsuccessful.7 And many startups have moved much more slowly than anticipated.8

What’s Special About the Digital Health Care Context

Platform strategy seeks to fit a platform with its environment, but the characteristics of health care make such a fit challenging to achieve. Although countries differ significantly in how they fund, organize, and deliver health care, multiple factors are consistent across nations and make the context for digital health platforms distinct from other platform businesses, no matter where they are deployed.9 The factors described below define a baseline from which to create a successful digital health platform strategy, yet these factors often limit how quickly the platform can scale.

At the platform (or company) level, health care organizations must manage multiple sources of sensitive data (patient records, platform, and medical device data) while meeting tight ethical and integrity standards. Many medical conditions are inherently complex, so service heterogeneity is high and a single digital platform is unlikely to deliver the full spectrum of medical services that a hospital often can. Organizations that create platforms in this sector are understandably risk-averse, and the need for service continuity (in particular, for patients with chronic diseases) can be at odds with the traditional platform-strategy logic of matching and optimizing each individual transaction. In addition, by definition, health care cannot be fully digitized. End-to-end care often requires in-person consultation and physical examination, so seamless integration between online and offline channels is critical.

At the ecosystem level, most if not all countries have highly complex health care ecosystems of actors — private and public hospitals, specialized ambulatory care centers, medical technology companies, insurance companies, patient organizations, regulatory bodies, and others — with the ensuing complexities of integration and division of labor. Health care is also tightly regulated, with permission-based entry, and the supply of highly trained providers (such as medical doctors) is often scarce because of labor shortages and occupational licensing requirements.

How to Succeed With Platform Strategy in Digital Health

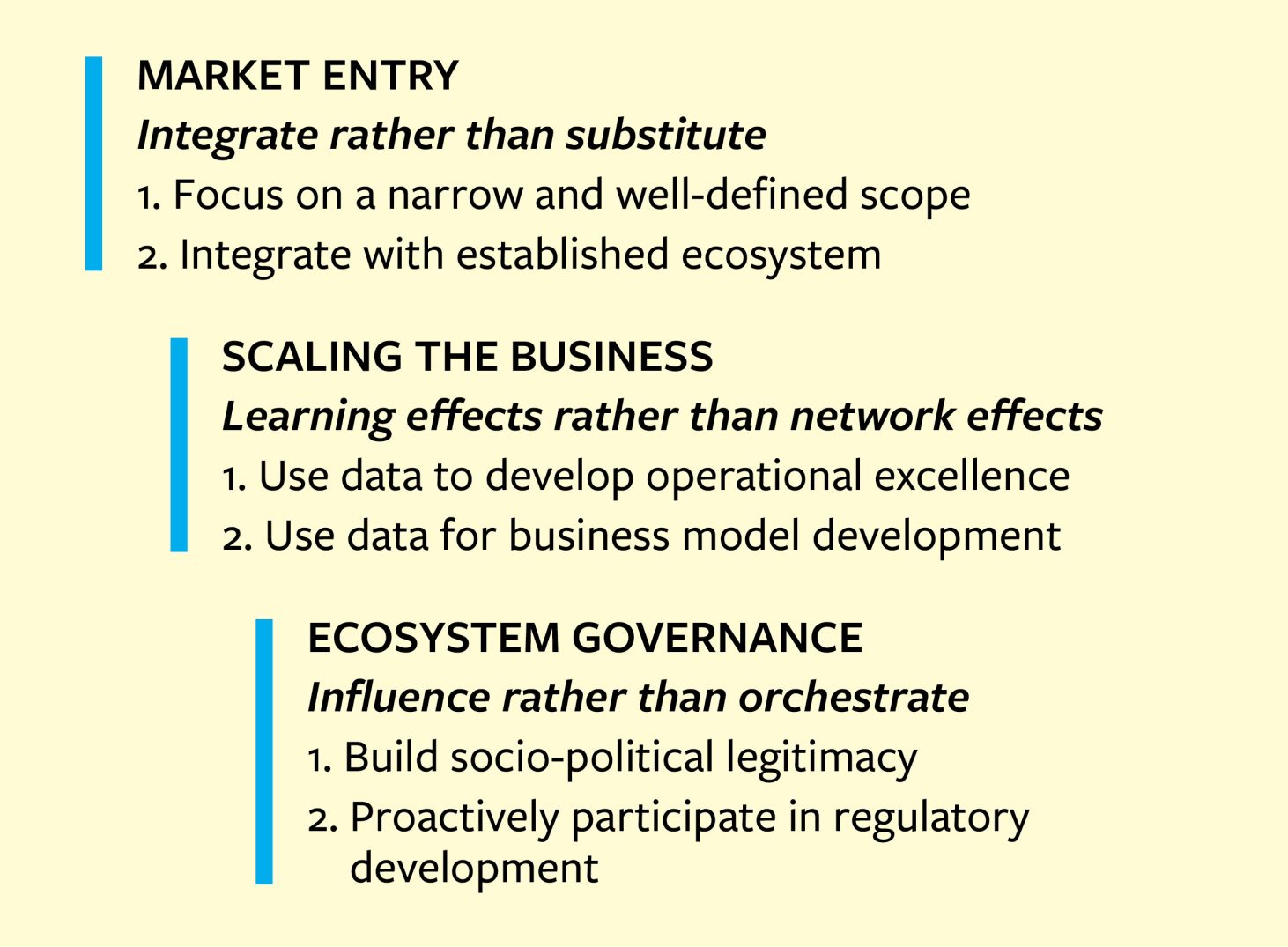

Deploying a platform strategy successfully in the complex health care sector requires an understanding of its unique conditions and demands. To avoid costly mistakes, organizations must shift their mainstream assumptions about platform strategy and make different decisions about three key domains — how to enter the market, how to scale the business, and how to govern the ecosystem — to align with a digital health perspective. (See “Platform Strategy for Digital Health.”)

Platform Strategy for Digital Health

Digital health platforms require a different approach for how to enter the market, scale the business, and govern the ecosystem.

Decision 1: How to Enter the Market

Mainstream view: Digital platforms are often viewed as major threats to traditional nonplatform businesses, especially if they compete directly.10 The literature underscores how platforms create new ecosystems of complementors that create and capture value.11 In fact, digital platforms typically enter markets by disrupting or replacing incumbent offerings.12 Examples include Amazon (supplanting physical bookstores), Spotify (physical music stores), and Airbnb (hotels). Under the mainstream assumptions, platforms enter markets by introducing novel and independent solutions that outperform and outcompete the old ones in one or more ways.

Digital health view: In health care, digital platforms typically extend rather than replace the established ecosystem, where existing actors remain important providers of complementary services. Digital health platforms can currently substitute for, at best, only about half of incumbent offerings in primary care and much less than that in specialty care, according to estimates by our interviewees. Therefore, digital health platforms must find ways to integrate with incumbent offerings when entering the market. Our interviews with digital health platform leaders made clear that the intention is not primarily to disrupt and substitute, although substitutions might occur in specific areas; instead, the goal is, first and foremost, to complement a large set of existing offerings.

Implications for market entry: To enter a market when they cannot disrupt established actors by building a competing ecosystem, digital health platforms should first focus on a narrow and well-defined scope for market entry. Successful digital health platforms have carved out a scope of activities and services that are better provided by such platforms. Moreover, they have carefully selected which specific geographical markets to enter and subsequently focused on integration efforts with the existing ecosystem. Digital health platforms can improve coordination and matching between health care supply and demand, thanks to simpler and more agile scheduling without the constraint of geographic location. But because many patient cases eventually require physical examination and treatment, geographic location nevertheless plays a key role for digital health platforms. More often than not, they need to provide a channel to physical health care services for their patients. This has proved difficult and costly, and therefore the selection of which geographical markets to enter is central. For digital health platforms, local might trump global, at least in the short to medium term.

Second, digital health platforms should design a scalable business model that accounts for the interface between digital and physical care. Digital health platforms must cooperate with physical health care units, at least in remitting patients to the right specialist care or referring patients to physical primary care centers when needed. Therefore, platform companies must actively choose whether to stick to digital offerings and partner with incumbents, or develop or acquire physical care units to integrate with their digital offerings in an omnichannel business model.

In the U.S. and Europe, several digital platform companies have acquired or opened physical care centers to provide combined offerings. While sometimes successful in home markets, some of the international attempts have proved disastrous. For example, as part of its U.S. expansion in 2021, London-based Babylon Health acquired First Choice Medical Group (with hundreds of clinicians in Fresno and Madera counties in California) and Meritage Medical Network (which represented hundreds of local physicians in the state). It turned out to be an overly aggressive expansion that contributed to the company’s 2023 bankruptcy. Notably, this type of move is costly if the broader strategy is global, which became painfully clear to Babylon Health.

Some platform companies that have used differing strategies for distinct markets have either left selected markets because it is costly to do too many things at once or started reverting to a purely digital business model to try to achieve profitability. Cases in point are Kry, which has withdrawn from the Spanish and German markets, and Min Doktor, which has started to pull out of its investments in physical care in Sweden. What both cases point to is that due to the nature of health care services, digital health platforms must deal with a tension between international scaling and local integration with physical care. Therefore, the health care context requires platform entrants to carefully consider interdependencies between the scope of services provided, the geographical markets to enter, and the integration of and interface between digital and physical health care.

Decision 2: How to Scale the Business

Mainstream view: The concept of network effects is central to platform strategy.13 Some platforms benefit from direct network effects, meaning that adding a user to the platform brings value to other users. For example, an additional person joining Facebook directly adds to the value their friends can realize. Other platforms benefit from indirect network effects.14 In these cases, having an increasing number of users creates incentives for providers of complementary resources to join the platform and develop new products and services, which subsequently increases the value for the platform’s users. When network effects are present, platforms can benefit from scaling rapidly through a variety of approaches, including subsidizing the use of the platform.15

Digital health view: Both direct and indirect network effects are limited for digital health platforms relative to many other types of platforms. Patients don’t gain much by having additional patients on the platform. And given how tightly governed and standardized health care delivery is, having a larger variety of physicians on a platform does not typically increase competition, services, or offerings. Moreover, health authorities regulate entry to both sides of a digital health platform. Therefore, although such platforms have network effects, such effects do not adequately explain why some digital health platforms succeed while others do not.

Our empirical findings instead underscore the importance of learning effects, which in this scenario refers to leaders learning from and leveraging user data to improve the digital health platform.16 Needless to say, learning matters in all types of platform development. In digital health care, though, learning effects are the primary way to benefit from user adoption and increase user retention on the platform, so managers must approach business scaling differently.

Implications for business scaling: To derive competitive advantage from learning effects, digital health platforms must start by collecting rich data on patient experiences throughout the health care delivery process. They can use the insights gleaned in two important ways: to develop operational excellence and to enable business model development.

On the operational front, successful digital health platforms in our research sample analyzed large volumes of user data and used digital technologies, data, and AI to improve customer experience, shorten wait times, and enhance the efficiency of health care delivery by optimizing frequently recurring processes and activities.

For example, the triage process is typically handled by nurses, who follow a protocol to sort, prioritize, and direct patients to the right level and type of care. Several digital health platforms are using their vast access to data to develop automated triaging to increase efficiency and improve performance. For example, Stockholm-based Platform24 developed a triage engine that is capable of handling 15% to 25% of all triage cases in a fully automated fashion and reducing personnel time spent on triage by more than 50% while maintaining accuracy and reducing manual errors.

Some companies focus narrowly on certain parts of the health care process to gather as much data and experience as possible by white-labeling their solutions and partnering with other platforms. For example, European and U.S. company Mediktor provides technologies for triage and pre-diagnosis that are sold to other platforms. Over time, this allows them to learn and improve their offerings, providing competitive advantage even without controlling the interaction between patients and physicians.

Data is useful not only for continually making operational improvements in small increments but also for identifying how to adapt, develop, and improve the business model. For example, when Stockholm-based Doktor24’s analysis of patient journeys revealed slow use and high dropout rates for certain user groups, such as older patients, it added app-free access to its platform via telephone and text messaging. This increased the volume of less digitally advanced users on the platform.

Decision 3: How to Govern the Ecosystem

Mainstream view: Ecosystem orchestration refers to exerting some level of control over the many independent stakeholders who contribute to and constitute a platform ecosystem. It often involves persuading others to behave in ways consistent with the ecosystem vision.17 For instance, Apple orchestrates an ecosystem of numerous independent third-party app developers. It governs the ecosystem by setting rules about who gets in (vetting criteria) and who gets out (through standardized contracts) and by supporting certain developments (with service-development kits and platform-specific codes of conduct). This kind of centralized orchestration, employed by keystone companies like Apple, is less applicable in the digital health platform context.

Digital health view: In sharp contrast with the mainstream view, our research shows that a set of heterogeneous actors participates in ecosystem orchestration relevant for digital health platforms. For instance, legislators and regulators set and enforce rules about who can serve as third-party service providers — specifically, who is permitted to operate as a physician and what organizations are accredited to provide health care. Governments often also determine reimbursement levels (pricing) and set the scope of tax-funded health care services (such as which ones get public funding and at what priority level). Health insurance companies can take on systems integrator roles by coordinating different independent solutions and actors in their offerings.18 In addition, specialized professional organizations develop medical guidelines on how to diagnose and address health care needs (thus setting rules for triaging and matching on digital health platforms). In effect, rather than central orchestration, there is distributed orchestration, leaving digital health platforms with the possibility to influence orchestration from a peripheral rather than central position.

Implications for ecosystem governance: Our research revealed two tactics by which digital health platforms influence the surrounding ecosystem. Medical professionals are trained to implement only evidence-based methods and to mistrust innovations that are ambiguous in terms of their compliance with evidence-based guidelines. To build trust and legitimacy not only among consumers but among physicians, regulators, insurers, and associations as well, platforms need to be transparent and generous in sharing data and evidence about the appropriateness, effectiveness, and safety of their services.

In Sweden, for example, accusations about overprescribing antibiotics to please consumers led to mistrust among physicians and primary care associations about platforms’ compliance with medical guidelines. Kry, Min Doktor, and Doktor24 responded by transparently sharing their prescription data, and they invested in comparing their prescribing levels with those of public health care providers. The data showed comparable prescription levels. Digital health platforms in Sweden have welcomed external reviews, which have used data from the platforms and other sources to assess the appropriateness of platforms’ practices, thereby giving them credibility. This open disclosure of internal practices has reduced concern about the appropriateness, relevance, and safety of digital health platforms.

Another important means of influencing the ecosystem is to proactively participate in regulation development. Indeed, digital health platforms globally emphasize the need for regulatory adjustments so that legislation can better accommodate the geographically independent delivery of online care that such platforms enable. Successful digital health platforms monitor and explain the consequences of existing regulations, not only for their own operations but also for third-party providers and patients. That information serves as input to further regulatory development.

European platforms, such as Kry and Min Doktor, collaborated with research groups that could provide evidence-based statements about how prevailing reimbursement systems (with different fees for digital services across regions) led to unintended financial consequences for individual regions when patients started using digital platform services. These insights were used as input when discussing nationally standardized reimbursement levels in Sweden.

Digital health platforms hold promise for addressing key challenges in health care systems worldwide, most notably regarding costs, productivity, and accessibility. These platforms also could be valuable complements to incumbent health care services, such as with specialized apps for particular diseases and online monitoring of chronic health conditions.

Leaders and managers of digital health platforms who focus on leveraging organizational learning effects, systematically integrating with the incumbent ecosystem, and using a distributed mode for ecosystem orchestration will be better positioned to manage, scale, and tailor their operations to targets that are appropriate regionally, nationally, and market-wise. Such changes in digital platform strategy in the health care sector will contribute to higher-quality and more innovative health services globally.