How Smart Products Create Connected Customers

The data streams generated by customers using smart, connected products can lead to new products and services.

Topics

News

- Gulf Nations Fast-Track AI Ambitions, UAE Leads Regional Readiness, says BCG Report

- AI Professionals form a Redefined Workforce. But Systemic Roadblocks Persist, Survey Finds

- AI-Driven Scams Surge as Microsoft Blocks $4 Billion in Fraud Attempts

- Identity-based Attacks Account for 60% of Leading Cyber Threats, Report Finds

- CERN and Pure Storage Partner to Power Data Innovation in High-Energy Physics

- CyberArk Launches New Machine Identity Security Platform to Protect Cloud Workloads

Jon Krause/theispot.com

As leaders of legacy product and service companies anchored in traditional value chains seek ways to prosper in the digital economy, one of the most important questions they can ask is, “How can we turn our existing customers into digital customers?” Digital customers don’t simply buy products and services: Their interactions with those products and services generate data that companies leverage to provide them with greater value over time. Those data insights also help companies attract new customers, create fresh revenue streams, and expand the scope of their businesses. This customer-generated data, which is often combined with other data streams, has fueled the growth engines of companies built on digital platforms, like Amazon and Google.

Legacy companies typically collect episodic data from discrete events — the sale of a product or the shipment of a component, for instance. Amazon and Google capture a continuous stream of data at every customer touch point on their platforms that is used to generate a new class of insights that play a more expansive role in their businesses. All of their customers are digital customers. Now, thanks to technologies such as sensors, the internet of things (IoT), and artificial intelligence, legacy firms, too, can transform their customers into digital customers who generate streams of data via their interactions with connected products.

Sleep Number uses sensors in its mattresses to track its customers’ sleeping heart rates and breathing patterns. This data enables the company to identify chronic sleep issues, such as sleep apnea and restless legs syndrome, and expand its business scope beyond mattresses to wellness provision. Sensors on Caterpillar heavy machinery produce data that enables the company to track wear and tear, predict component failures, and create new revenue streams from maintenance services. Chubb is installing sensors in the buildings it insures to detect water leaks before they become claims. In this way, the company is expanding beyond damage compensation to damage prevention.

For all its promise, harnessing value from digital customers also brings new challenges for legacy companies. They must develop new value propositions, build out their data infrastructures and strategies, staff for new digital and product design capabilities and competencies, and rework innovation processes to create a feedback loop using valuable customer interaction data. And they must learn to market and sell their new value proposition to create a new digital customer base — and reap the benefits of their digital transformation.

New Value Propositions Create Digital Customers

Transforming legacy customers into digital customers requires the development of a new value proposition that convinces them to switch from buying a standard product to using a sensor-equipped product. To appreciate this effort, consider the recent introduction of smart inhalers for the prevention and treatment of asthma by pharmaceutical companies, including AstraZeneca, GlaxoSmithKline, and Novartis.

The standard asthma inhaler consists of a canister that holds the medication and a plastic actuator with a cap that releases the right dose of the medication when pressed. A smart inhaler, on the other hand, has a sensor on the plastic actuator that can collect various kinds of data and transmit it via Bluetooth connectivity to a mobile phone or wearable device, and to the manufacturer and its partners from there.

Companies must build out their data infrastructures and strategies, staff for new digital capabilities, and rework innovation processes.

Asthma sufferers who use smart inhalers are digital customers. They use a smart inhaler the same way as a standard inhaler, but when they do, the smart inhaler generates data, such as the time and date, the patient’s location, and the dose inhaled. Because its sensor can capture the angle at which the inhaler is held when the medication is released, a smart inhaler can estimate the amount of medication that went into the lungs of the user (as opposed to the amount sprayed into the mouth).

With the help of APIs that enable communication between different software programs, smart inhalers also can collect and use environmental data from other IoT devices within homes, such as those that detect mold or dust mites. Outside the home, they can tap other environmental data sources that provide real-time updates on pollen, humidity, pollution, and other irritants that can cause an asthma attack.

All this data enables the makers of smart inhalers to offer a broad range of features to their digital customers, such as reminders to take preventive doses and to carry inhalers when leaving home. Indeed, a key benefit of smart inhalers is improved adherence to medication regimes and hence better control of asthma and fewer acute attacks. Smart inhalers also can send help to users who are experiencing a severe attack — a feature that could save lives.

The deeper analysis of the data enables advanced features. Smart inhalers can not only predict acute attacks by detecting known irritants but can also customize predictions by knowing precisely which irritants are more likely to trigger attacks in an individual patient. They can help physicians fine-tune medication dosages for individual patients too.

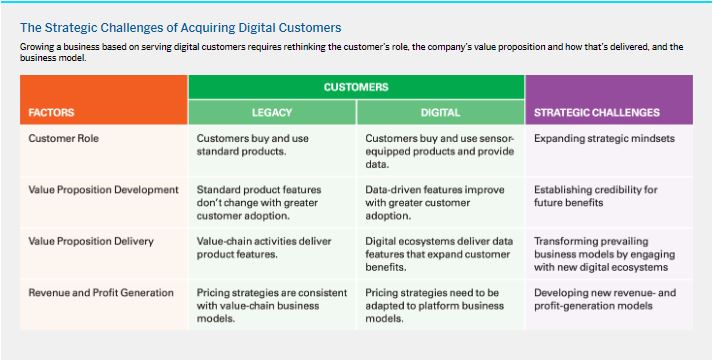

Introduced in 2014, smart asthma inhalers are still in their infancy, and they account for less than 1% of the market. Moreover, most of the smart inhalers on the market today offer relatively basic features, like reminders. But the market is expected to grow from an estimated $34 million to $1.5 billion by 2025. This growth could be far more robust depending on how successfully producers address the strategic challenges entailed in converting legacy customers into digital ones. (See “The Strategic Challenges of Acquiring Digital Customers.”)

Expanding Strategic Mindsets

Harnessing the power of digital customers and their data for digital transformation requires leaders to move beyond outdated strategic mindsets. This begins with changing prevailing views on the role of the customer. Most companies see buying products as the customer’s role, but digital customers play a broader role as generators of the data that can fuel new services and revenue streams. The more clear-eyed leaders are about this broader role, the more likely it is that they will invest in acquiring digital customers and make the necessary changes in business models to harness their value.

Leaders also might need to refresh their understanding of the relationship between products and data. Managerial perspectives anchored in the product value chain can make it difficult to envision the full spectrum of opportunities offered by the data that user interactions generate. Even companies that have launched smart products might use what they learn from the resulting data streams only to enhance the product’s functionality. This can be limiting: A robotic vacuum’s sensor that detects obstacles can produce data that, when analyzed, points to ways to improve the appliance. But the vacuum could also be equipped with sensors that detect the presence of rodents or termites, enabling vacuum makers to offer pest activity alerts and connections to pest control companies, in addition to a cleaner floor.

Finally, taking full advantage of digital customers and the data they generate requires that leaders think beyond economies of scale to embrace network effects. Growing numbers of digital customers and additional partners, such as environmental data providers, produce greater volumes of data and thus can strengthen the algorithms that power smart inhalers, for instance, which in turn will deliver more insights that offer greater value to all network participants. This attracts more participants and creates a virtuous cycle of growth. Legacy companies that unleash network effect advantages on top of scale advantages can not only win market share away from incumbent competitors but also maintain the scale advantages that help block new digital competitors.

Establishing Credibility for Future Benefits

Smart products are a marketing challenge for legacy companies: They must sell digital customers on a product’s value proposition before the value has been proved. The customer benefits of standard products are embedded in their features — think the medicinal properties of a conventional inhaler or the number of blades in a razor. But for smart products, the customer value proposition includes data-driven features and benefits that might materialize only after a substantial number of digital customers have adopted the product. For instance, the ability of a new smart inhaler to predict asthma attacks is nonexistent when it is first launched in the market. This benefit materializes only after digital customers have generated the data needed to power the inhaler’s predictive algorithms.

One way to communicate and sell digital customer value propositions that has gained some traction in the B2B arena is outcome-based pricing. When GE launched its sensor-equipped jet engines, locomotives, and turbines, it adopted this pricing strategy to show that it stood behind its ability to deliver the as-yet nonexistent data-driven services associated with its products. The ability of GE’s jet engines to provide pilots with guidance on how to achieve fuel efficiencies, for instance, would only materialize after enough data was available from the engines’ sensors. To underscore its confidence that such guidance would be forthcoming, GE redesigned its commercial terms, selling the sensor-equipped engines at a reduced price and then charging customers a percentage of the actual savings derived from the improved fuel and operational efficiencies that would eventually be realized from its digital services.

Transforming Prevailing Value Chains Into Digital Ecosystems

The value chains designed to produce and sell standard products are insufficient for delivering data-driven features to digital customers. Companies need data-generating and -sharing networks that comprise both production and consumption ecosystems. Each part enables legacy companies to use the interactivity data captured from smart products to provide data-driven services, but each delivers data-driven services of different kinds and in different ways.

Production ecosystems emerge from conventional value chains as various assets and activities involved in producing, selling, or servicing products become networks that generate and share data. They started emerging with IT systems that used data to automate business processes. Now, the addition of sensors, IoT, and AI further enriches these ecosystems and elevates their capacity to generate data-driven services.

For example, Caterpillar evolved its traditional after-sales services into data-driven predictive maintenance services by building out its production ecosystem to channel data from thousands of its products in the field to data centers equipped with sophisticated AI capabilities needed to pinpoint likely breakdowns. These centers are digitally linked to various other value chain entities, such as spare parts warehouses and service centers, that enable Caterpillar to deliver predictive maintenance services to its digital customers.

Leaders must ensure that customers are comfortable with sharing the data generated by their engagement with a connected product.

Consumption ecosystems are focused on connections external to value chains. They, too, are data-generating and -sharing networks, but they link the independent entities that complement a product and its sensor data — such as the providers of data on local levels of asthma triggers like humidity and pollution levels. Unlike the units and entities inside a legacy company’s value chain (such as Caterpillar’s data centers and spare parts warehouses), the company does not directly control the participants in this network. Consumption ecosystems also require the development of new technology infrastructure: a digital platform through which customers access data-driven services, and partners deliver complementary services.

Pricing for Digital Customers

Attracting and serving digital customers requires new revenue models. Standard product pricing strategies don’t factor in the significance of network effects — which may allow companies to tap new revenue sources other than product sales.

Consider Samba TV, vendor of a video content recommendation engine and viewer-tracking app. Since 2011, Samba TV has been providing sensors to TV manufacturers, including Sony, TCL, and Sharp. Rather than charging for the sensors, Samba TV pays manufacturers to use them and earns its revenue by selling the resulting data and insights to content producers and advertisers.

The smart inhaler producers, by contrast, charge a premium for the enhanced value proposition of their sensor-equipped products — but one consequence of this approach has been a slow rate of adoption.

When catering to digital customers, legacy firms must find a balance between recovering costs to reach breakeven and driving smart product adoption to generate network effects. To do this, they must find creative approaches to engaging digital customers in ways that not only help build network effects but also generate revenues.

The challenges of turning a legacy company’s customer base into digital customers don’t end with fundamental changes in strategic mindsets and the adoption of new marketing, business, and revenue and profit generation models. Leaders also will need to ensure that customers are informed and comfortable with sharing the data generated by their engagement with a connected product, and they must continually appraise their products vis-à-vis evolving and newly emerging digital technologies.

The privacy concerns of digital customers, in particular, must be top of mind. Companies must maintain customer privacy and data security and ensure that they don’t use digital technologies and data in ways that cause harm or violate ethical norms. And it’s essential to communicate privacy and data collection policies in an easy-to-understand way — not via pages of legalese. When the business of harvesting data from smart TVs emerged, it certainly raised concerns among consumers, who didn’t expect their television sets to surveil their viewing habits or collect information on other internet-connected devices in their homes.

Digital customers are one of the key enablers of a legacy firm’s digital strategy. The data acquired from these customers empowers businesses to dramatically expand their value scope — but to win these customers, companies must differentiate their offerings through innovative data-driven services. Achieving sustained success and a strong competitive position requires a commitment to both investing in production and consumption ecosystem infrastructure and enhancing value-added services via complementary partnerships that ultimately contribute to positive network effects.