How to Manage Tech Debt in the AI Era

AI is transforming business — and increasing technical debt in enterprise systems. Consider these four key insights for leaders on evaluating trade-offs and ensuring innovation capacity.

Topics

News

- UAE to Add 1M+ Jobs By 2030, Driven by Tech Sector

- Not All AI Firms Will Pull Through, Says Bill Gates

- Google Launches Gemini 3 Flash to Power Real-Time AI Agents at Scale

- UAE Quietly Launches Its First Regulated Online Gaming Platform

- MBZUAI and AWS Join Hands for AI Research, Skills Development, and Startup Growth

- Nutanix and Pure Storage Launch Integrated Full-Stack Virtual Infrastructure

Carolyn Geason-Beissel/MIT SMR | Getty Images

Technical debt is an anchor, dragging down business leaders’ efforts to run a tight ship. The accumulated costs and effort from IT development shortcuts, outdated applications, and aging infrastructure sap a company’s ability to innovate, compete, and grow.

A degree of technical debt is inevitable. To remain agile, businesses often choose to deploy new technologies as quickly as possible, knowing that they may have to pay to fix their systems later. Addressing this trade-off is becoming more critical as companies adopt artificial intelligence. With over $2.41 trillion in annual costs in the United States alone, tech debt isn’t just an IT problem; it’s a business liability that requires CEOs’ attention.

Outdated infrastructure and applications aren’t just slowing companies down. Tech debt prevents organizations from deploying AI solutions that could reshape how they compete. The stark reality is that with AI poised to penetrate every business function, all technical debt is becoming AI technical debt.

In the past, experts recommended injecting a healthy dose of digital decoupling and modularity into the tech stack to address technical debt — that is, breaking code, infrastructure, and data (for example) into smaller, interchangeable parts that could be replaced more easily when better technology emerged.

To understand how today’s business leaders are reinventing their organizations, including the role tech debt plays, Accenture studied 1,500 global companies in 10 countries covering 19 industries and conducted scores of in-depth discussions with C-level leaders. The research found that companies that are well positioned for change have a reinvention-ready “digital core” — a set of key components such as cloud infrastructure, data, and AI that can be easily updated. They also typically set aside around 15% of their IT budgets for tech debt remediation.

What the research made clear is that today, addressing tech debt is not about eliminating it but managing it. The key lies in knowing what the debt is, what to fix, what to keep, and how to recognize the tech debt that is boosting your company’s innovation capacity.

For example, the snack company Mondelez International, known for popular brands like Oreo, Belvita, and Cadbury, is using new technologies, including generative AI, to keep up with and even get ahead of changing consumer preferences. To enable these applications and prepare for the future, Mondelez upgraded the data and AI portions of its digital core along with the cloud infrastructure, security, and cloud management platforms supporting them.

To prepare for the upgrades, Mondelez needed help with its tech debt. The company was grappling with a highly fragmented IT landscape that included more than 1,000 applications. Some of those applications not only were redundant but also cost time and money to maintain. Together, Mondelez and Accenture assessed each application, evaluating metrics such as software quality, performance, and operating costs. Through this work, Mondelez created a consolidated set of applications that reduced both the total cost of ownership and tech debt through savings on infrastructure, licenses, and application management services.

As a result, Mondelez can make the most of opportunities to use AI. Together with Accenture and Publicis Groupe, Mondelez launched a new platform that uses generative AI to improve its global marketing capabilities and optimize consumer experiences.

Managing Tech Debt Now: Four Key Insights

From our work with companies such as Mondelez, we’ve identified four key insights that can help business leaders manage technical debt in the era of AI.

1. Zero tech debt is not the goal.

Many leaders aiming for zero debt funnel resources into erasing legacy system inefficiencies. This is a mistake because, as noted earlier, some degree of tech debt is inevitable. Systems start incurring technical debt as soon as they go live. The cost of maintaining and updating these systems grows exponentially with their complexity and age.

Instead, companies need to effectively manage their tech debt by treating it as a necessary cost of doing business. The categories that lenders use to make decisions about their loan portfolios — principal, interest, liabilities, and opportunity costs — offer a way to think about what technical debt to target:

- Principal is the cost of updating outmoded technology.

- Interest is the incremental cost associated with working around outmoded technology.

- Liabilities are the additional issues that occur when outmoded technology is not updated.

- Opportunity cost is the set of opportunities a company cannot realize due to outmoded technology.

Companies should start remediating their tech debt with the principal — that is, at its source. If they effectively manage the principal, as they would financial debt, it will accrue little or no interest and minimize any liabilities or opportunity costs. With these priorities in mind, leaders can make better investment decisions.

For example, companies can focus on the quality of the code in their software. If the code is not well written, debugged, improved, or maintained, technical debt can proliferate. Modern software development tools can help developers minimize errors that will turn into tech debt principal later.

2. Know good technical debt from bad.

Businesses may intentionally incur tech debt to achieve short-term goals. When leaders lack a clear understanding of good versus bad technical debt, their companies can become paralyzed by accumulating inefficiencies.

Fear of debt can also prevent companies from taking strategic risks. The companies Accenture studied differentiate between necessary debt and liabilities they need to address or avoid.

Good technical debt is an investment. It enables experimentation, learning, and faster time to market. One way to ascertain whether a debt is good is to consider whether the opportunity cost of avoiding the debt is greater than the debt itself. This is often the case when companies are deploying emerging technologies.

Consider a company that is deploying a custom generative AI chatbot for internal knowledge management that leaders envision will assist customer service representatives and product designers. Due to knowledge and skill gaps, the company is bound to encounter a learning curve that could result in bugs or poorly written code. Developers may even choose the wrong model as the foundation for the chatbot.

If the prospect of accruing this technical debt gives leaders cold feet, they might pull the plug on the project — and regret it. In that scenario, the company wouldn’t have the team or talent in place to take advantage of more mature solutions as they emerged. If a competitor were to use those tools, the company would have lost an opportunity to differentiate its customer service or product design.

3. Focus on the highest-value fixes.

Many companies lack a structured approach to prioritizing debt remediation. They waste resources on low-value fixes while neglecting critical ones.

Managing Technical Debt: The PAID Framework

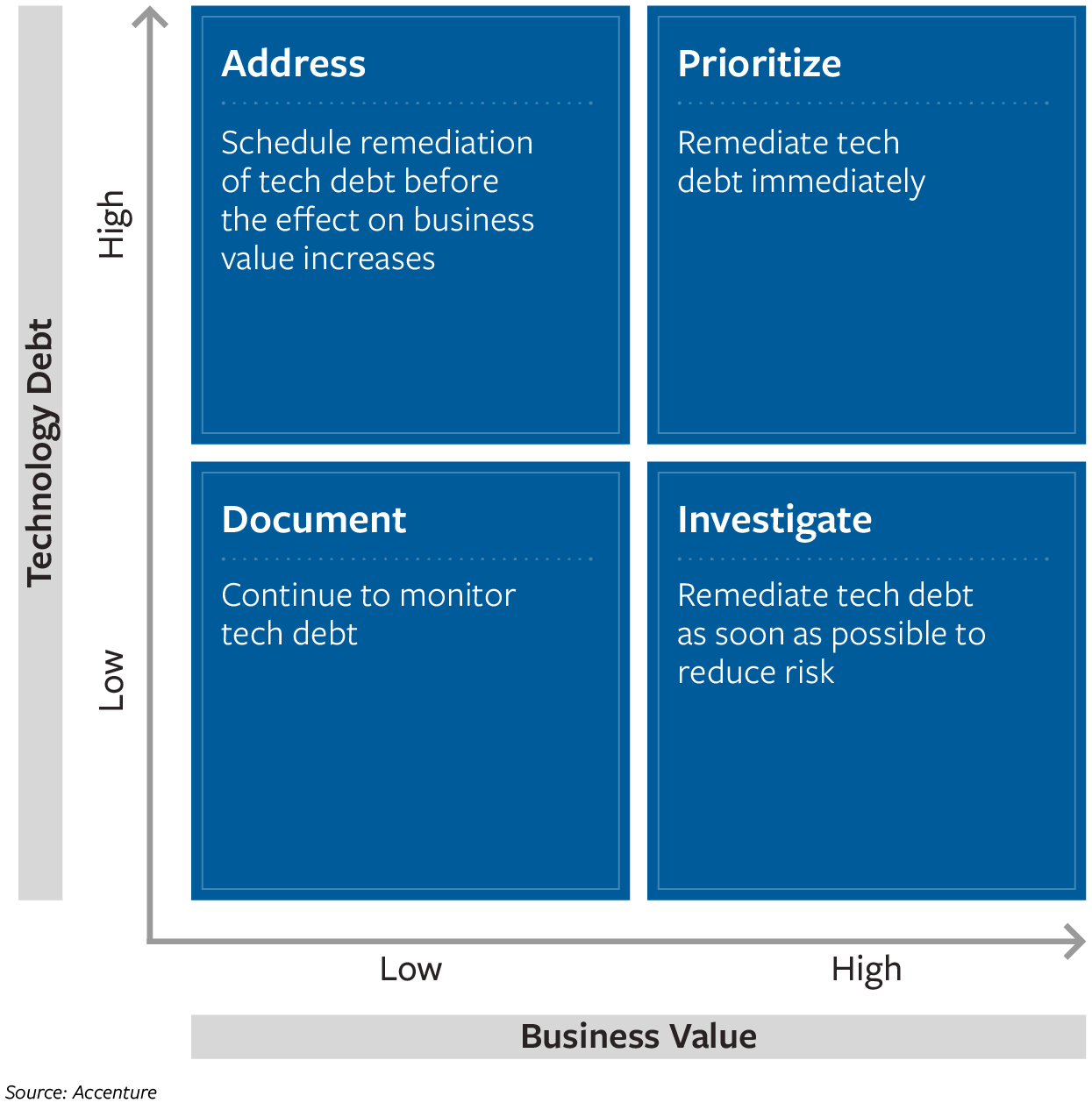

Decisions about whether — and when — to remediate a particular technical debt should be based on the level of debt and how much the debt affects business value. We developed the PAID framework (as shown in the graphic) to help leaders assign actions based on business value and the amount of tech debt that needs remediation. The acronym is based on four key actions:

We developed the PAID framework (as shown in the graphic) to help leaders assign actions based on business value and the amount of tech debt that needs remediation. The acronym is based on four key actions:

- Prioritize: When both the level of tech debt and its effect on business value are high, the debt needs immediate remediation. Consider, for example, a health care provider that has a large repository of patient data that is scattered across numerous systems and silos. Such decentralization affects the speed and quality of care the organization can deliver, with potential consequences for patients’ well-being.

- Address: When the level of tech debt is high but the effect on business value is low, the debt should be scheduled for remediation before the effect on business value increases. A bank might have an outdated customer relationship management system that works efficiently but is limiting the personalization it can offer customers. It will want to upgrade this system to avoid losing customers to competitors.

- Investigate: When the level of technical debt is low but the impact on business value is high, neglecting the situation could be risky. Consider a consumer goods company with an outmoded inventory management system: It might notice some difficulty with long-term financial planning, and although the system does not need immediate attention, leaders should plan to monitor it to understand when remediation will be needed and avoid unexpected shocks.

- Document: When both the level of tech debt and impact on business value are low, tech debt should be monitored, but remediation should be a low priority. For example, a small HR team may be using obsolete report-generating software, but if the team and its work may soon be merged with another business unit, it will no longer need the application.

The PAID framework is useful whether or not a company is getting ready to deploy AI. However, if a company’s leaders intend to leapfrog to the latest AI-enabled services, this framework can facilitate decisions to strategically write off technical debt that falls into the framework’s Document category.

CTT – Correios de Portugal, the 500-year-old national postal service of Portugal, prioritized tackling a costly patchwork of on-premises digital systems. They were a challenge to manage and were hindering the development and deployment of new services. CTT reduced IT operating costs by 15% by migrating some of its data center workloads to the cloud. And it is poised to reap dividends from accessing the cloud provider’s technological advances immediately and continuously rather than accruing its own technical debt internally.

4. Reframe tech debt as innovation capacity.

Companies burdened by outdated systems struggle to scale, compete, and deliver new value. They are at risk of being overtaken by savvier competitors. When technical debt reaches critical levels, it leaves companies vulnerable to being disrupted or going out of business.

Technical debt was one of several key factors that led to the 2022 bankruptcy of Sungard Availability Services, a provider of on-premises IT disaster recovery services. In the years before the bankruptcy, Sungard began adjusting to a changing business environment. Customers were starting to prefer cloud-based services to owning on-premises data centers for backups. Sungard had outlined its plans to address its technical debt as it shifted its business model accordingly.

But the organization did not move fast enough. When demand for cloud services, including remote working capabilities, intensified during the COVID-19 pandemic, Sungard’s substantial technical debt meant it couldn’t compete with more cloud-focused competitors.

Now that AI is becoming synonymous with innovation, reframing tech debt remediation as an investment in innovation capacity can shift the conversation about remediation to one about the upside of AI-enabled opportunities. For example, thanks to CTT’s cloud environment, CTT can get to work on a new AI solution in a matter of hours, not weeks, when customer preferences or the business environment changes.

Tech debt is no longer an IT-only issue; it’s a strategic challenge that requires CEO and leadership oversight. Leaders who manage tech debt effectively can transform their IT systems into a tool for growth, balancing the trade-offs between agility and efficiency. By embracing continuous management of technical debt, distinguishing good debt from bad, prioritizing high-value remediations, and reframing tech debt remediation as an investment in innovation capacity, leaders can ensure that their organizations not only survive but also thrive in an AI-first world.