Unleash the Unexpected for Radical Innovation

Breakthrough inventions arise unpredictably. Better exploration can identify surprising opportunities.

News

- Saudi Arabia AI Firm Humain Invests $3bn in Musk’s xAI

- Perplexity Rolls Back AI Ads to Prioritize User Experience

- UAE Banks Phase Out OTPs Amid Fraud Surge

- Data Leak at Abu Dhabi Finance Week Exposes Details of 700+ Delegates

- Alibaba’s Latest Open-Weight Qwen3.5 Enters a Crowded Field

- MBZUAI Secures $1M from Google.org to Narrow AI’s Language Divide

Patrick George

The accelerometer chip — a small but radical innovation — is ubiquitous in today’s digital devices. These speed and orientation sensors tell our phones whether they’re being held in portrait or landscape mode, deploy airbags in our cars, and track our forehands when we play virtual tennis. They also help sense when the earth starts to shift before earthquakes or volcanic eruptions. But while it is easy to recognize the significance of this innovation retrospectively, its true impact didn’t become apparent until many of today’s most valued applications were developed. This gradual unveiling of an innovation’s potential over time is a surprisingly common pattern — so common, in fact, that companies need to craft their innovation management systems with this phenomenon in mind.

Here’s how the accelerometer made its mark. In the early 1980s, an R&D scientist at Analog Devices learned of a new invention in the world of integrated circuits that incorporated mechanical devices within their designs. Today, we know that innovation as microelectromechanical system, or MEMS, devices. The scientist was intrigued enough to invite the inventor, a professor at a nearby university, to give a talk to Analog’s R&D group. He then began to experiment with design and generated ideas with colleagues on packaging such a device on a circuit board, the benefits the technology could provide, and how such systems could be manufactured at scale. He expected that there would be uses in the automotive industry, a sector attractive to Analog because automobiles were becoming increasingly dependent on smart electronic systems. Eventually, the team demonstrated the potential of these new devices to sense changes in speed and showed how they could be produced economically, and thus the accelerometer chip was born.

Over the next 10 years, the company searched for applications in the automotive market. Airbag detonators were its first target, but along the way, many more applications surfaced, mostly outside of the automotive industry. Eventually, Analog found that the device could be modified to enable advances in video game technology, training simulators, medical instrumentation, sporting goods, optical telecommunications, and satellite technology, including gyroscopes. The company also began receiving inquiries for more and more use cases such that, by the time the technology’s foreseen applications in the automotive industry were being adopted, its unforeseen applications were already transforming many other markets.

This case is just one example of how ideas that at first appear to simply be an interesting leap, a next step in product development, or a combination of known technologies can turn out to have more radical impacts. As such technologies are incubated, both the company and the broader market learn more about them. Unanticipated use cases emerge and, in many instances, are far afield from those that were originally imagined, perhaps leveraging different characteristics of the technology or different business models.

The Difficulty of Predicting Radicalness

While the story of the accelerometer is one of amazing success, it also speaks to Analog’s ability to fully explore the idea’s potential. Those opportunities can be missed if much of that radicalness appears only as a technology incubates. How much radical innovation is lost because organizations abandon projects before this radicalness appears?

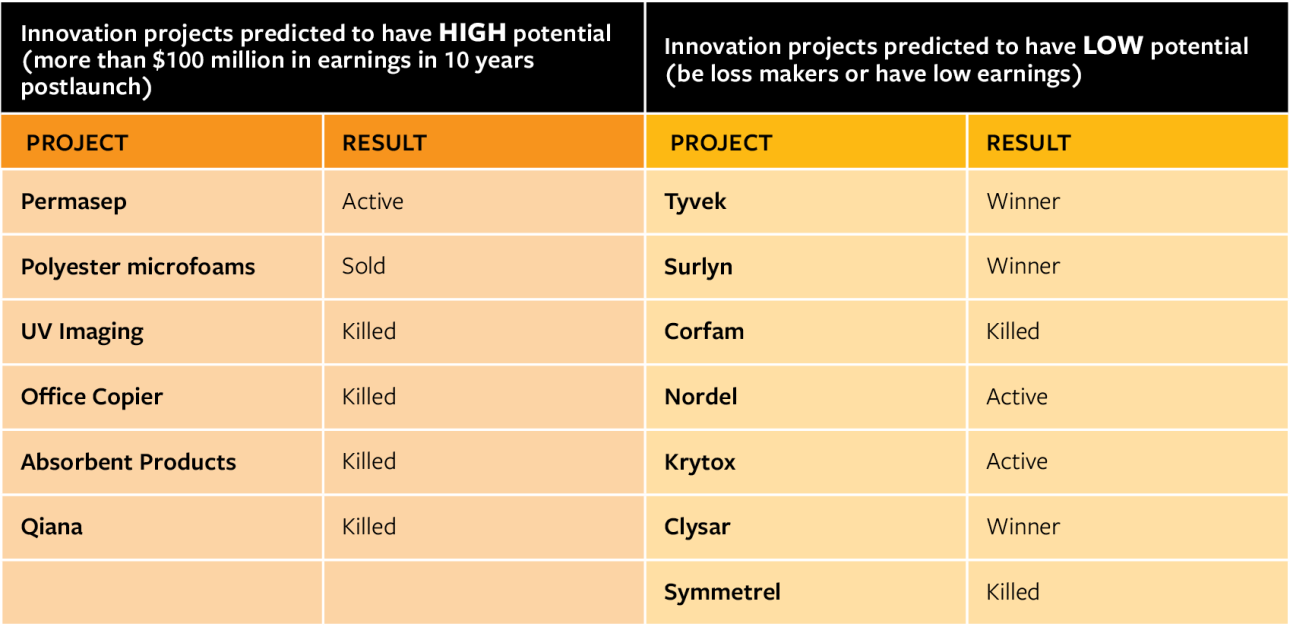

One of the starkest illustrations of the unpredictability of achieving “breakthrough” status for a particular project is a seminal analysis published by DuPont. In 1968, R&D managers were asked to consider projects that were early in their development and identify which ones should be abandoned as well as those they considered to be discontinuous innovations, defined as having the potential for a “sudden appearance of a breakthrough in technology that can yield entirely new products, processes, or services” that result in high reward for a company.1 Thirty years later, in 1997, their answers were compared with the actual outcomes. (See “DuPont’s Predictions of Radicalness.”)

DuPont’s Predictions of Radicalness

In 1968, Dupont R&D scientists predicted outcomes for certain early-stage projects. The table below shows the projects’ actual outcomes as of 1997.

The results showed that the managers were wrong more often than they were right and that they had both overestimated and underestimated projects’ prospects. Some projects that managers had considered promising ended up being abandoned, irrelevant, sold, or killed. Only 1 in 6 of these expected high-reward projects was still active. In contrast, of the seven projects expected to fail because of low returns, three — Tyvek, Surlyn, and Clysar — had become clear winners, two others remained in development, and two had been killed. So not only were breakthroughs unpredictable even for a company taking this question as seriously as DuPont, but all but three of its successful breakthroughs would have been lost had it acted on the opinions of managers who couldn’t yet see their promise.

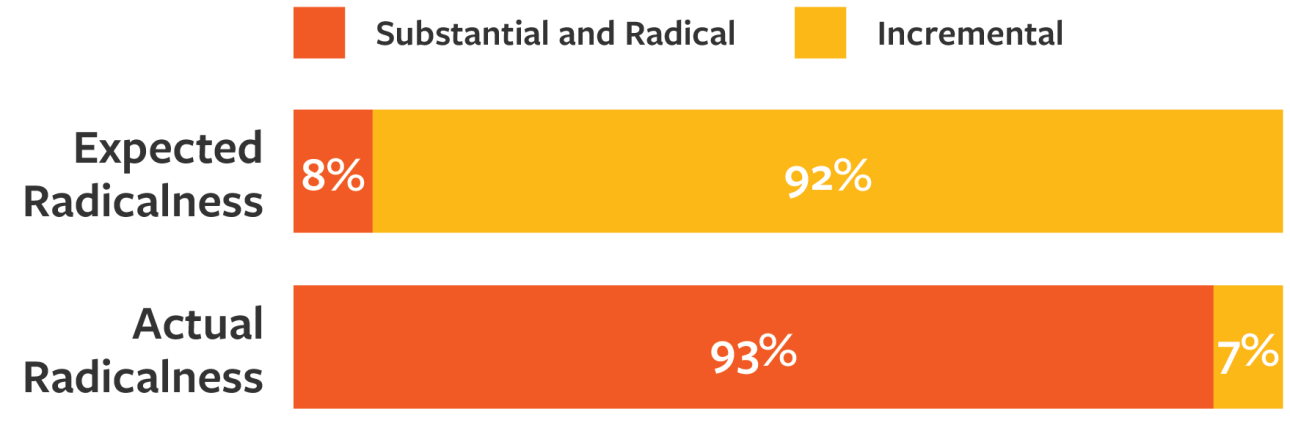

Our own research confirms how difficult radicalness is for R&D leaders to predict. We asked respondents at 300 large corporations across seven industries in seven countries about the most successful project they had developed in the past few years — specifically, whether the innovation was judged to be incremental, substantial, or radical initially, and whether that prediction was borne out. In fact, while 93% of the projects wound up being substantially or radically innovative (as might be expected of respondents’ most successful projects), initial expectations for most — a full 92% — had been that they would be merely incremental. (See “Expectations Were Low for Successful Innovation Projects.”)

Expectations Were Low for Successful Innovation Projects

Survey results show the radicalness that innovation leaders at 300 companies expected when they started what turned out to be their most successful innovation projects — and how dramatically those expectations differed from their after-the-fact appraisals.

Practices to Search for More-Radical Opportunities

When executives rely on their initial assessments of an innovation’s radicalness, they tend to skip the work needed to purposefully consider a broad array of contexts and industries the idea might affect. That leaves the organization less aware of emergent opportunities and more likely to treat them as out-of-scope surprises, or even annoyances, when they crop up. R&D teams or technology scouts might discover breakthrough technologies but be unable to prove that the market is big enough.

“We have big ideas that are incrementally executed,” the CTO at one company told us. He went on to describe an example in which the first, most obvious application of a novel technological platform that fit with one business unit’s expectations was easily transitioned to a commercialization team, but many other potential opportunities were left on the table, completely unexplored. At another company, the central R&D organization was tasked with identifying, selecting, and developing advanced technology programs that would produce breakthroughs aligned with the company’s current business units, according to the CTO. Two years later, he realized that the most exciting opportunities emerging from these programs were in fact not aligned with the business units, but since R&D hadn’t planned for this outcome, no alternative mechanism was in place for pursuing them.

In both of these cases, two organizational competencies might have helped the innovation teams uncover hidden breakthrough potential: proactive discovery and wide-eyed incubation.

Proactive discovery is the work a team undertakes to identify the myriad possibilities an invention might offer. Team members invest effort upfront to identify the multitude of applications, use cases, and markets that might be newly created as a result of these advances. Through outreach to thought leaders, engagement with experts from other industries, and a host of other methods that provoke associative thinking, discovery teams can uncover the opportunity landscape that a novel technology, idea, or business model could offer.

Proactive discovery can play a big role in convincing internal decision makers that a specific opportunity is worth pursuing. It can also affect how big an impact a technological breakthrough can have, by broadening the number of industries and markets it can potentially influence. And, of course, when radical innovations do surface, it can profoundly affect the company’s growth.

Nutrition and bioscience company DSM engaged in proactive discovery in the early 2010s, after having made advances in protein development that led to the development of its clean cow feed additive. The additive reduces a cow’s methane emissions by more than 30% without any adverse effects on the animal’s welfare, feed consumption, or performance.

The members of DSM’s strategic innovation team also looked for other applications for the additive: They read scientific and market research, attended conferences and trade shows, interacted with thought leaders, and imagined potential applications. The team also identified and catalogued many potential opportunities for proteins while maintaining the highest sustainability standards. As a result, DSM was well prepared as these markets began to emerge. It has since commercialized products such as a canola-based protein isolate that can be used to increase the quantity and quality of protein in plant-based alternatives without introducing soy or gluten; textured vegetable proteins to be used as food additives; and solutions for manufacturing cheese, ice cream, and other dairy products.

At DuPont, several years after the project analysis described earlier, a director of new business development engaged in proactive discovery by placing advertisements in scientific journals and trade magazines soliciting input on potential use cases for new materials arising from ongoing internal R&D programs. Each advertisement described the properties of the material being developed and invited readers — presumably R&D colleagues in other companies — to contact his new business development team with potential applications. An ad for a biodegradable polyester (later named DuPont Biomax) received more than 100 inquiries and resulted in over 20 different applications that DuPont explored. The bio-based materials business ultimately grew from one formulation to an entire family of offerings, none of which had been anticipated.

Learning Through Incubation

Discovery is a necessary first step, but it is not sufficient for assessing how promising an opportunity might become. Doing this requires a next step — incubation — to more fully examine each of those opportunities that proactive discovery surfaced.

Wide-eyed incubation is the process of vetting the myriad opportunities and testing the many uncertainties that have been uncovered during proactive discovery.2 This process can involve diverse activities, such as clarifying the performance thresholds needed for a technology to be valuable for a specific use case, working out viable business models that the company is willing to use, or collaborating with partners to fill gaps in the company’s expertise.3 New applications can emerge as the market is engaged and technical development proceeds.

The interactions with market agents and technical experts during incubation surface additional unanticipated uses and benefits. With wide-eyed incubation, team members are motivated to explore those opportunities rather than narrow their focus and deem the applications out of scope. As the team comes to understand the market, the market comes to understand the potential benefits the technology can deliver, and thus an increased understanding of the radicalness of the innovation takes shape.4

Over time, ICL Group, a multinational chemical company, developed and improved a capability to produce high-purity phosphates. They were initially used only in fertilizers, but as the purity levels have improved, they have been incorporated into food and a number of other applications. When a Chinese battery company approached ICL to buy phosphate materials, the ICL team realized that lithium iron phosphate could address problems in the lithium battery market. Ultimately, it won a large grant from the U.S. Department of Energy to explore this and other opportunities adjacent to battery technology.

These examples show how difficult it is to predict how radical an innovation project will be, even for companies already in the process of incubating the project — just as they show how critical incubation is during the commercialization process for avoiding the loss of important opportunities.

Internal R&D Helps Capture an Innovation’s Radicalness Potential

With so much unexpected potential emerging during incubation, one might wonder whether the source of the innovation matters. For example, external innovators, such as universities or startups, may look more broadly than an established company that has difficulty seeing beyond its sector, and thus be able to identify and execute on more promising opportunities.

Surprisingly, our survey data shows that more unanticipated radicalness is found when projects are developed by internal R&D teams: On average, these projects become 1.5 points higher in radicalness (p<.001) on a scale from 1 to 7 than do innovations that are sourced externally. This greater ability to foster radicalness internally makes sense for several reasons. First, organizations that develop, own, and nurture the technology themselves may be better able to communicate within their internal networks about the innovation, and other organizational members may spot a use that hadn’t previously been considered. In a survey of 47 members of the Innovation Research Interchange, a professional association of mid- and senior-level R&D leaders, a number of management practices were positively correlated with commercial success from radical innovation. Of the 15 management practices that were measured, the strength of informal internal networks — the relationships that employees form across functions and divisions to share knowledge and accomplish tasks — was the most strongly and significantly correlated with radical innovation commercial success, with the correlation coefficient r=.56 (p<.0001).5

Many companies seem to recognize the importance of these informal networks. 3M is famous for its Tech Forum poster sessions, in which internal R&D members present their current projects and colleagues from other parts of R&D and the business units come to learn about the R&D portfolio. Many creative collisions have occurred as a result of the forum, which has been run for over 65 years.

GE’s fluoroscopic imaging technology was originally developed for use in its avionics unit. The R&D scientist who led that program recognized that GE Medical Systems’ Imaging business might benefit from the technology, which could image movement in ways that had the potential to offer whole new levels of diagnostic data over conventional CT scanning technologies. The scientist mentioned the possibility to a colleague in R&D who was dedicated to the GE Medical Systems division, and ultimately this led to the MRI imaging technology that GE commercialized — a completely unexpected breakthrough in the industry.

A second reason why internal innovation sourcing can be beneficial is that internal leaders have greater control over the strategic choice points that inevitably arise on a technology’s development path than they do with corporate venture investments or university lab research that their company may be funding. Which applications to pursue, which technological platforms to use, how to integrate a radical innovation with other known technologies, and other critical decisions are completely under the control of the company’s decision makers. For externally developed innovations, the large company could take on the role of customer, investor, or board member but would not have absolute decision authority. This type of relationship limits the organization’s ability to deeply understand the nuances of the technology’s potential, or to shape its development path or strategic choices.

Interestingly, the DuPont experience also provides a case study supportive of the benefits of internal innovation sourcing. Across all 13 projects in its portfolio, DuPont had three winners, a 23% success rate. This is notably higher than what is found when venture capital performance is measured, where win rates are estimated to range from 0.05% to 5%.6

These findings do not negate the importance of open innovation, technology scouting, and external sourcing as critical components of a company’s innovation activities; these relationships and activities often make up for important capability shortfalls.7 Rather, our results indicate that relying on open innovation to the exclusion of meaningful investments in purposeful exploratory R&D may decrease the likelihood that a company will realize the innovative potential of a new technology.

The Rewards of Unanticipated Radicalness

One might imagine that unanticipated radicalness would be a mixed blessing, since radical projects are typically more difficult to implement than incremental innovations. Greater unexpected radicalness could increase the innovation’s impact but could also make its implementation more challenging. Interestingly, this does not seem to be true. While our data affirms that more radical projects are generally harder to implement, if the radicalness emerges as project development progresses (for example, during incubation), it seems to be less difficult to implement than expected.

These findings suggest an additional benefit of uncovering these hidden radical innovations: They will be disproportionately easy to implement. This is exemplified by a project that a smartphone app company undertook for geolocating customers. The initial purpose of the project was to make weather predictions and inform customers about canceled events. As the project progressed, the team came to recognize more (and more important) ways to use the geolocation information, such as customizing location-specific advertisements, facilitating real-time location exchanges among cohorts for meetups, and providing personalized recommendations based on customers’ location histories. With a deeper understanding of the potential breadth of the market and the scope of the technology’s impact that emerged through incubation, the company’s leaders became more willing to invest in its commercialization.

The pattern of projects becoming easier to implement as they become more radical can be explained through dynamics that emerge when a market is introduced to new technology (technology push). While technology push is often criticized as a worse approach to innovation management than listening to the market and meeting its requirements (market pull), we find that as the market learns about the technology, technology push can turn into market pull.

For example, one of our interviewees, a research fellow at IBM, described giving a talk at a scientific conference in which he mentioned a phenomenon associated with a gallium arsenide-based chip. At the end of the presentation, an R&D scientist from another company approached him with a problem he’d been unable to solve; that audience member ultimately became the first customer for a use case that had not been considered by the inventor or his team. This example and others like it demonstrate that as technology push occurs, the market begins to pull, which can smooth the path for implementation.

The recent rapid development of drone technology is another example of technology push leading to market pull. In our interviews, a leader at an industrial drone startup mentioned starting the business with one “relatively simple goal”: increasing the precision of mapping. As the company developed the technology, it realized that precision mapping could be integrated with other technologies (such as a flight control system) to develop new industrial drone products. The company incubated many of these new use cases, such as drone-based inspection of photovoltaic power plants, which led to many new offerings.

In sum, the further a technology is taken through the discovery and incubation process, the more it can find promising applications where internal or external users will demand it and smooth the implementation process.

Embracing the Surprise of Radicalness

We encourage organizations looking to increase their radical innovation capabilities to follow four guiding principles.

1. Avoid overdependence on external technological sources. Depleting internal R&D in an effort to fully embrace open innovation is a path many companies have chosen of late. Our research results suggest that leveraging the full breakthrough impact of innovations without the internal networks, decision control, and deep expertise that come with continued investments in internal R&D will be challenging. Companies might also need to broaden their technology expertise beyond the areas that are directly applicable to the business units, to better explore opportunities that would be more radical.

2. Build internal capabilities for proactive discovery. The objective of discovery is to generate and elaborate the richness of an opportunity landscape. Rather than presuming that a technology offers one solution for a big, widely held problem, use tools to stimulate divergent thinking, imagination, and the early exploration of use cases and their implications in terms of product offerings and market segments. One option is to map technology, applications, market segments, and product formulations, in any order, within a problem/opportunity domain. This process helps teams recognize the many different ways their company could participate in addressing a complex problem area that requires radical innovation.

3. Have the patience to cultivate innovation projects through incubation. During the incubation process, it is possible that a killer application that has never before been imagined will surface as a result of interactions with other niche markets. Tools such as the Learning Plan project management approach and discovery-driven planning can be used to vet opportunities.8

4. Staff the discovery and incubation teams with new business creation expertise. This is not the same thing as R&D skills. Corning’s exploratory marketing and technology teams have engaged in proactive discovery for each major R&D program where there were no immediately obvious use cases but plenty that could be imagined. DuPont eventually instituted inbound marketing teams within R&D to find applications for many of the ideas emanating from its central R&D facility and then begin testing them with interested parties. Each of these examples points to the importance of hiring, developing, and promoting people with strategic innovation opportunity generation and new business creation skills.9

Ultimately, organizations must be prepared to take advantage of surprises. When companies are laser-focused on finding a technological solution for a known problem, they tend to ignore the unanticipated signals of enthusiasm that come from internal and external markets. Companies that have discovery and incubation capabilities in place must also be willing to devote attention and financing when these types of surprises arise. Part of the art of radical innovation is embracing surprises with an open mind and agile exploration of their potential beyond the confines of the anticipated.

References

- P.M. Norling and R.J. Statz, “How Discontinuous Innovation Really Happens,” Research Technology Management 41, no. 3 (May-June 1998): 41-44.

- M.P. Rice, G.C. O’Connor, and R. Pierantozzi, “Implementing a Learning Plan to Counter Project Uncertainty,” MIT Sloan Management Review 49, no. 2 (winter 2008): 54-62; and R. McGrath, “Seeing Around Corners: How to Spot Inflection Points in Business Before They Happen” (Boston: Houghton Mifflin Harcourt, 2019).

- C. O’Reilly and A.J.M. Binns, “The Three Stages of Disruptive Innovation: Idea Generation, Incubation, and Scaling,” California Management Review 61, no. 3 (2019): 49-71.

- G.C. O’Connor and M.P. Rice, “New Market Creation for Breakthrough Innovations: Enabling and Constraining Mechanisms,” Journal of Product Innovation Management 30, no. 2 (March 2013): 209-227.

- D. Krackhardt and J.R. Hanson, “Informal Networks: The Company Behind the Chart,” Harvard Business Review 71, no. 4 (July-August 1993): 104-111.

- J. Xavier, “75% of Startups Fail, but It’s No Biggie,” Silicon Valley Business Journal, Sept. 21, 2012, www.bizjournals.com; and D. Gage, “The Venture Capital Secret: 3 out of 4 Start-Ups Fail,” The Wall Street Journal, Sept. 20, 2012, www.wsj.com.

- N.C. Thompson, D. Bonnet, M.J. Greeven, et al., “Why Innovators in China Stay Close to the Market,” MIT Sloan Management Review 64, no. 1 (fall 2022): 28-32.

- Rice, O’Connor, and Pierantozzi, “Implementing a Learning Plan,” 54-62; and R.G. McGrath and I.C. MacMillan, “Discovery-Driven Planning,” Harvard Business Review 73, no. 4 (July-August 1995): 44-54.

- G.C. O’Connor, A.C. Corbett, and L.S. Peters, “Beyond the Champion: Institutionalizing Innovation Through People” (Stanford, California: Stanford University Press, 2018).